Sukanya Samriddhi Yojana (SSY) was inaugurated by the Prime Minister of India, Shri Narendra Modi. The scheme was launched by the Government of India on January 22, 2015, as a part of the “Beti Bachao, Beti Padhao” campaign. The inauguration ceremony took place in Panipat, Haryana, and marked the official implementation of the Sukanya Samriddhi Yojana across the country.

Objective of Sukanya Samriddhi Yojana

The main objective of Sukanya Samriddhi Yojana is to promote the welfare of the girl child and ensure her financial security for higher education and marriage expenses. It aims to encourage parents or legal guardians to open a savings account for their girl child and make regular contributions towards it.

Features of Sukanya Samriddhi Yojana

Key features of Sukanya Samriddhi Yojana include:

- Eligibility: The scheme is available to parents or legal guardians of a girl child below the age of 10 years.

- Account Opening: An SSY account can be opened at designated post offices or authorized banks across India.

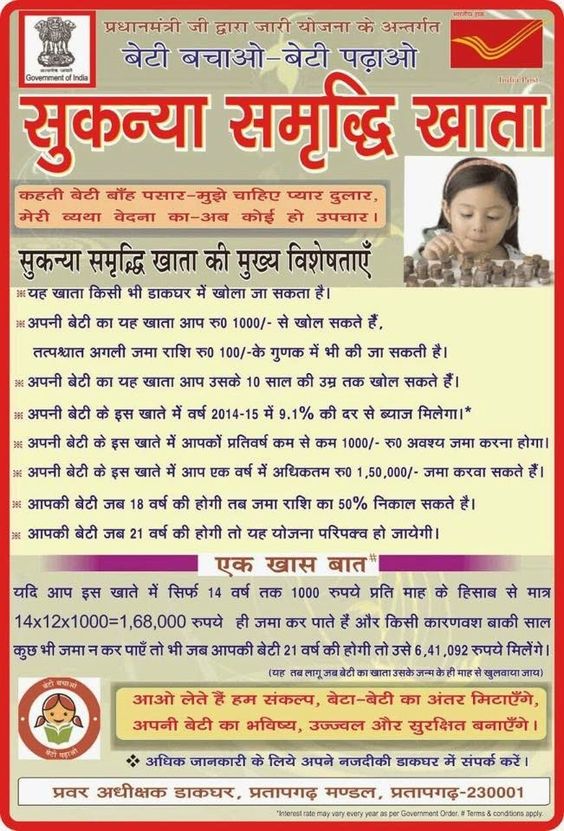

- Deposit and Tenure: A minimum initial deposit of Rs. 250 is required to open the account, followed by subsequent deposits in multiples of Rs. 100. The account matures after 21 years from the date of opening or when the girl child gets married, whichever is earlier.

- Interest Rate: The interest rate is set by the government and revised periodically. The interest is compounded annually and is currently higher than most savings schemes. It is often higher than the inflation rate, making it an attractive investment option.

- Contribution Limit: The maximum annual contribution limit is Rs. 1.5 lakh. This can be made in multiple deposits or a lump sum amount.

- Tax Benefits: Contributions made to Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act. The interest earned and the maturity amount are also tax-free.

- Withdrawal Rules: Partial withdrawals are allowed after the girl child attains the age of 18 years, subject to certain conditions.

Sukanya Samriddhi Yojana has gained popularity among parents as it provides a secure and long-term investment avenue for their daughters’ future needs. It promotes the welfare of the girl child by encouraging education and financial independence.

How to Apply for Sukanya Samriddhi Yojana

- Visit a Post Office or Authorized Bank: Sukanya Samriddhi Yojana accounts can be opened at designated post offices or authorized banks. Locate a nearby post office or bank branch that offers the scheme.

- Carry Required Documents: Carry the necessary documents for opening the account. These typically include:

- Birth certificate of the girl child.

- Identity proof of the parent/legal guardian (such as Aadhaar card, PAN card, or Passport).

- Address proof of the parent/legal guardian (such as Aadhaar card, Passport, or Utility bill).

- Filled application form for Sukanya Samriddhi Yojana, available at the post office or bank.

- Fill out the Application Form: Obtain the application form for Sukanya Samriddhi Yojana and provide the required details accurately. The form usually asks for information such as the girl child’s name, birthdate, parent/guardian details, and address.

- Submit the Application and Documents: Submit the filled application form along with the necessary documents to the post office or bank officials. They will verify the documents and process your application.

- Make an Initial Deposit: Pay the minimum initial deposit amount (currently Rs. 250) to open the Sukanya Samriddhi Yojana account. You may also be required to provide additional funds to reach the minimum deposit requirement.

- Collect the Passbook: After completing the application process and making the deposit, the post office or bank will provide you with a passbook for the Sukanya Samriddhi Yojana account. The passbook contains details of the account, such as the account number, deposit amount, and interest earned.

- Make Regular Contributions: Make regular contributions to the account as per your financial capability. The contributions can be made through cash, check, or online transfers, depending on the facility provided by the post office or bank.

Remember to keep the passbook safe and updated with all transactions. It’s important to review the scheme’s rules and regulations and consult the post office or bank officials for any specific requirements or changes in the application process.

Benefits of Sukanya Samriddhi Yojana

- Financial Security for Girl Child: SSY aims to provide long-term financial security for the girl child by encouraging parents or legal guardians to save for her future needs, such as higher education or marriage expenses.

- Attractive Interest Rates: The scheme offers competitive interest rates, which are typically higher than those provided by other savings schemes. The interest is compounded annually, helping the savings grow faster.

- Tax Benefits: Contributions made to Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act, up to a specified limit. The interest earned and the maturity amount are also tax-free, making it a tax-efficient investment option.

- Low Minimum Deposit: The scheme allows for a low minimum deposit amount, making it accessible to individuals from different income groups. The initial deposit requirement is currently set at Rs. 250.

- Flexible Contribution Options: Parents or legal guardians can contribute to the account in multiples of Rs. 100, providing flexibility in making regular deposits or lump sum payments as per their financial capacity.

- Long Tenure: The Sukanya Samriddhi Yojana account has a long tenure of 21 years from the date of opening or until the girl child gets married, whichever is earlier. This allows for a substantial accumulation of savings over time.

- Partial Withdrawals: The scheme allows for partial withdrawals after the girl child attains the age of 18 years. This can help meet her educational expenses or other financial needs while ensuring that the savings continue to grow.

Empowerment of Girl Child: Sukanya Samriddhi Yojana promotes the welfare of the girl child by encouraging her education and financial independence. It aims to empower girls by providing them with a dedicated financial resource for their future endeavors.

It’s important to note that the specific benefits and terms of the scheme may be subject to change, so it’s advisable to refer to the official guidelines and consult with the post office or bank offering the scheme for the most up-to-date information.

FAQ on Sukanya Samriddhi Yojana

Q. Can I get Sukanya Samriddhi Yojana Calculator?

Click the below link of Sukanya Samriddhi Calculator

SSY Calculator 2023 – Calculate Maturity Amount & Interest Earned (scripbox.com)

Q. What is Sukanya Samriddhi Yojana interest rate?

Sukanya Samriddhi Yojana offers 8% interest rate.

Q. How to download Sukanya Samriddhi Yojana app?

Sukanya Samriddhi Yojana application can be downloaded from Google Play Store by Android users. The application has a plan feature to calculate the amount you will receive upon maturity. Enter investment amount and interest, to get result.

Check out my other websites and blogs if you want to Earn Online Money or If you want to start your own Passive Income.

Keywords on Sukanya Samriddhi Yojana.

- sukanya samriddhi yojana interest rate

- sukanya samriddhi yojana in hindi

- sukanya samriddhi yojana post office

- sbi sukanya samriddhi yojana interest rate 2020-21

- sukanya samriddhi yojana details

- post office sukanya samriddhi yojana

- sukanya samriddhi yojana scheme